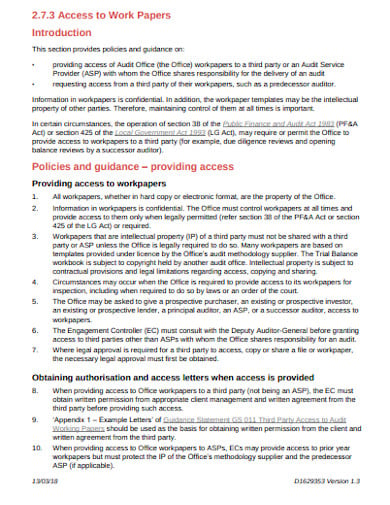

audit working papers are the property of

Working papers are the property of the auditor and some states have statutes that designate the auditor as the owner of the working papers. Then who is the owner of audit working paper.

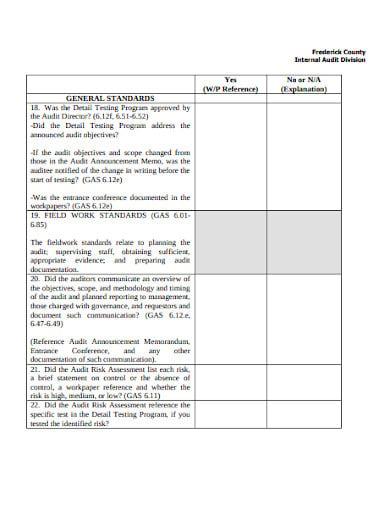

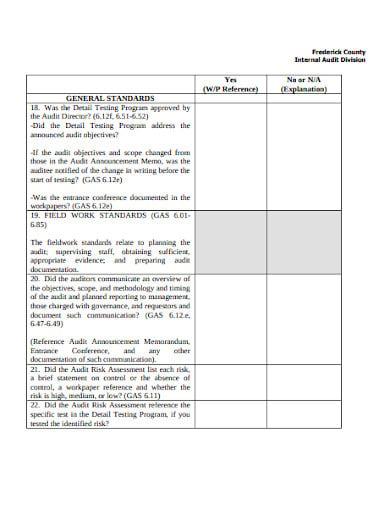

Sufficient and appropriate documentation should include evidence that the audit working papers have been reviewed.

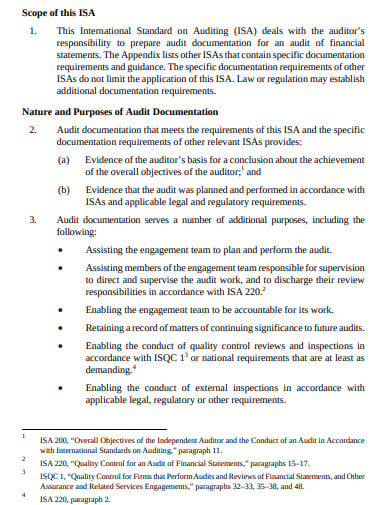

. Owned by the client. In order to keep professional ethic it cannot reveal to third parties without client consent unless limited specified situations mentioned in ISA 230 Documentation and required by law the examples are court order. They are not a part of nor substitute for the clients accounting records.

They provide evidence that sufficient information was obtained by an auditor to support his or her opinion regarding the underlying financial statements. Of audit working papers as the supporting for the basis on which financial statement is approved by the auditor. She may at her discretion make portion or extracts from audit documentation available to the client c.

Hence the data become more meaningful and useful for the purpose of theaudit. Working paper is the property of the auditor. The auditors arrange the data properly in the working papers.

Although the client may claim them as a record of his business matters the auditor cannot part with them as his conclusions are based on them and as they provide evidence of the audit work carried out according to the basic principles. The clerk comes across through serve difficulties which he has to discus with his senior auditor or to note down several inquiries which he think have not been satisfactory such book is called an Audit Note Book Audit memorandum and Working Paper. Thus the working papers are the property of the auditor.

Solved Answer of MCQ Audit working papers are the property of. The Auditor may at his discretion make portions of or extracts from his working papers available to his clients. So they are his property.

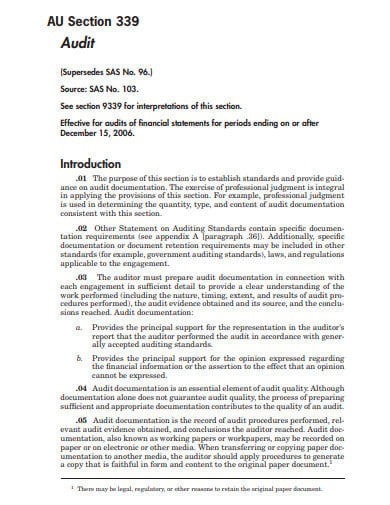

Audit working papers are the property of the auditors who may destroy the papers sell them or give them away Criticize this quotation. Guidelines of Audit Working Papers as specified in SA-230 Audit Documentation. The working papers are the matters documented by the auditor.

Working Papers prepared or obtained by the auditor in connection with the performance of audit are the property of auditor and it is the duty of the auditor to retain and preserve the working papers for a period of 7 years. Audit papers are the property of _____. Audit documentation is the property of the client and sufficient and appropriate copies should be retained by the auditor for at least 5 years b.

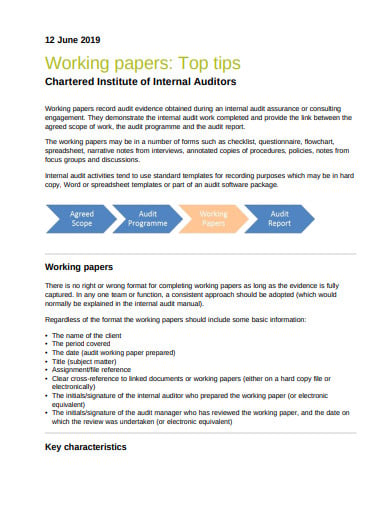

Working papers are the record of various audit procedures performed audit evidence obtained allocation of work between audit team members etc. Audit working papers are used to document the information gathered during an audit. They cannot distort them because it can be used as an evidence if there would be litigation they cannot be sold or given to third.

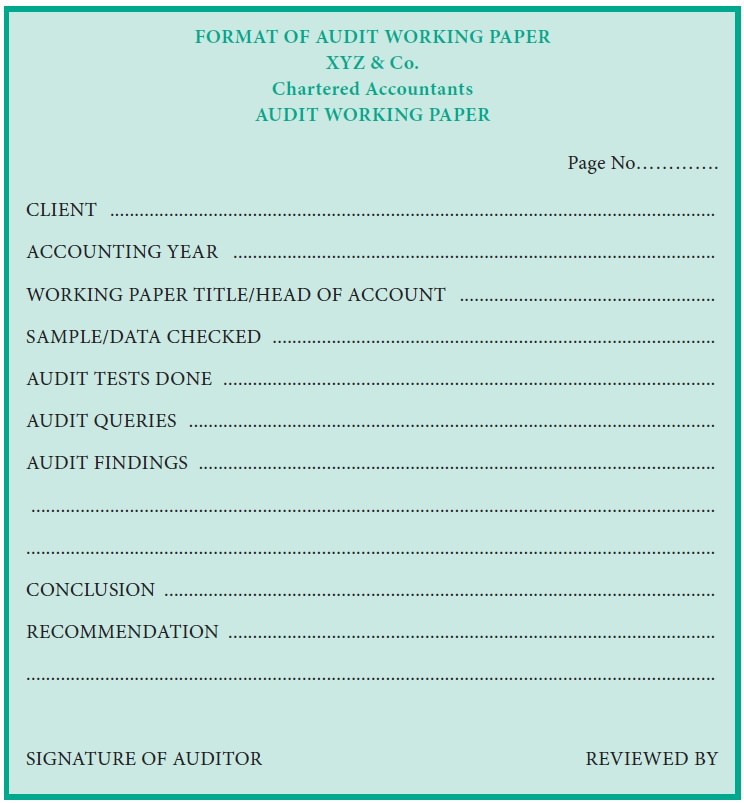

Name of the company under audit title of the working paper company. The Auditors Working Papers are divided into two parts is the specific guidelines and directions for efficient and effectivecompletion of the audit work on timely and daily basis so as to minimise audit risk. Audit working papers are sometimes referred to as audit documents.

Audit working papers are the property of the auditor. Although audit working papers are property of the auditors they should not be sold distorted or given to third party as it will violate the Code of Ethics of Confidentiality because what is contain in the audit working papers are information about the client. Ownership of Audit working papers.

C Management of the entity being audited. Audit working papers refer to the documents prepared by or use by auditors as part of their works. Thus the audit working papers are the property of auditor and not of the client.

Audit programme provides instructions to the audit staff and reduces scope for. Audit working papers are the property of the auditor. Click to see full answer.

Working papers are the property of the auditor and some states have statutes that designate the auditor as the owner of the working papers. The ownership of working papers belongs to the auditor. Working papers are necessary to corroborate the work and the findings of all the audit staff.

B title of the working paper. Audit working papers are the property of the auditor. In order to keep professional ethic it cannot discover to third party without consent of the client unless limited specified situations mentioned in ISA 230 Documentation and required by law the.

The auditors rights of ownership however are subject to ethical limitations relating to the confidential relationship with clients. What is Audit Working Papers. In order to keep professional ethic it cannot discover to third party without consent of the client unless limited specified situations mentioned in ISA 230 Documentation and required by law the examples are court order for public interest and so on.

Evidence for audit conclusions. Audit working papers are the property of the auditor. Owned by the auditor.

Audit working papers are the documents and evidence that an auditor collects and retains with himself during the audit. Although audit working papers are property of the auditors they should not be sold distorted or given to third party as it will violate the Code of Ethics of Confidentiality because what is contain in the audit working papers are information about the client. Principles of Auditing Other Assurance Services 21st Edition Edit edition Solutions for Chapter 5 Problem 23RQ.

Audit documentation prepared on audits of public entities is the property of the. Name of the company under audit. A review of the audit working papers gives an assurance that the audit work is both accurate and complete.

Audit working papers are the property of _____. - a Client - b Accountant - c Auditor - d Registrar of companies - Advance Accounting and Auditing Multiple Choice Question-. D all of these.

C companys year-end date. Working papers also provide evidence that an audit was properly planned and supervised. Retained in auditor office until a change in auditors.

Which of the following statement is correct. The auditors rights of. The working papers are the property of the Auditor.

The working papers which auditor prepares for financial statements audit are _____. The quantity of audit working papers complied on engagement would most be affected by _____. Those documents include summarizing the clients nature of the business business process flow audit program or procedure documents or information obtained from the client and audit testing documents.

10 Audit Workpaper Templates In Pdf Word Free Premium Templates

Audit Working Papers Types Characteristics Information

10 Audit Workpaper Templates In Pdf Word Free Premium Templates

Guide To Standard On Auditing Sa 230 Audit Documentation

10 Audit Workpaper Templates In Pdf Word Free Premium Templates

10 Audit Workpaper Templates In Pdf Word Free Premium Templates

The Medical Algorithmic Audit The Lancet Digital Health

10 Audit Workpaper Templates In Pdf Word Free Premium Templates

Working Papers In The Audit Process Definition Development Study Com

Audit Working Papers Meaning Definition Contents Objectives Importance Or Advantages Auditing

Working Papers In The Audit Process Definition Development Study Com

Auditing And Accounting During And After The Covid 19 Crisis The Cpa Journal

Audit Process 5 Expert Steps For You To Get Your Audit Right Process Street Checklist Workflow And Sop Software