how to avoid tax on 457 withdrawal

Beneficiaries can avoid taxation by rolling over the 457 distribution to a qualified retirement account of their own. Upon withdrawal however you have to report the income and pay taxes on it.

4 Ways To Minimize Taxes On Retirement Plan Withdrawals Smartasset

100s of Top Rated Local Professionals Waiting to Help You Today.

. All withdrawals are taxable regardless of the participants age. All contributions to 457 plans grow tax-deferred until retirement when they are either rolled over or withdrawn. However distributions from a ROTH 457 plan are not subject to tax withholding.

Since dividends and interest are taxed at ordinary income rates you will minimize your tax liability more than if you had those assets in a brokerage account. If you withdraw from your IRA or 401k and youre younger than 59 and 12 you will incur an additional 10 tax in addition to whatever your ordinary tax rate is. You want to avoid early distributions because they trigger an additional 10 tax penalty compared to withdrawing the money after age 59 12.

Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. If you have a 457 plan and you die your beneficiary can take distributions from the plan immediately. Withdrawing money from a qualified retirement account such as a 457 plan can create a sizable tax obligation.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. This is the case even though the CARES Act eliminates the 10 early withdrawal penalty. How to avoid tax on 457 withdrawal.

You cant avoid paying income taxes by simply never taking distributions either. Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. Withdrawals from 457 retirement plans are taxed as ordinary income.

Like most retirement accounts the IRS imposes. You can avoid paying taxes on your CARES Act retirement withdrawal if you are able to put the money back in the account within three years of the distribution. He or she can help you build a tax-efficient.

Use this calculator to see what your net withdrawal would be after taxes are. Contributions accumulate on a tax-deferred basis until distributed or for 457f plans when the employee is fully vested. IRC 457 Early Withdrawal.

Leave this money invested while you are working and pay current out-of-pocket medical expenses from other sources. There are exceptions to this rule however. Unlike other retirement plans under the IRC 457 participants can withdraw funds.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Tax Withholding and Estimated Tax. Beneficiary distributions avoid the early withdrawal penalty of 10 percent.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. If you are short.

In this case enter the 10 additional tax on line 8 of Schedule 2 Form 1040 Additional Taxes PDF PDF and write No on the dotted line next to that line. Once you reach age 72 you have to start taking required minimum distributions RMDs. Theres some good news for those participating in a 457 plan.

You can then use this money to cover qualified. While you cant avoid paying taxes on a 401 k withdrawal its a good idea to work with a financial advisor on your retirement plan.

Retirement Withdrawals Before 59 1 2 Without A Penalty Youtube

A Guide To 457 B Retirement Plans Smartasset

How Cares Act Eases Retirement Account Rules Forbes Advisor

401 K Early Withdrawal 11 Ways To Cash Out Without Penalty

A Guide To 457 B Retirement Plans Smartasset

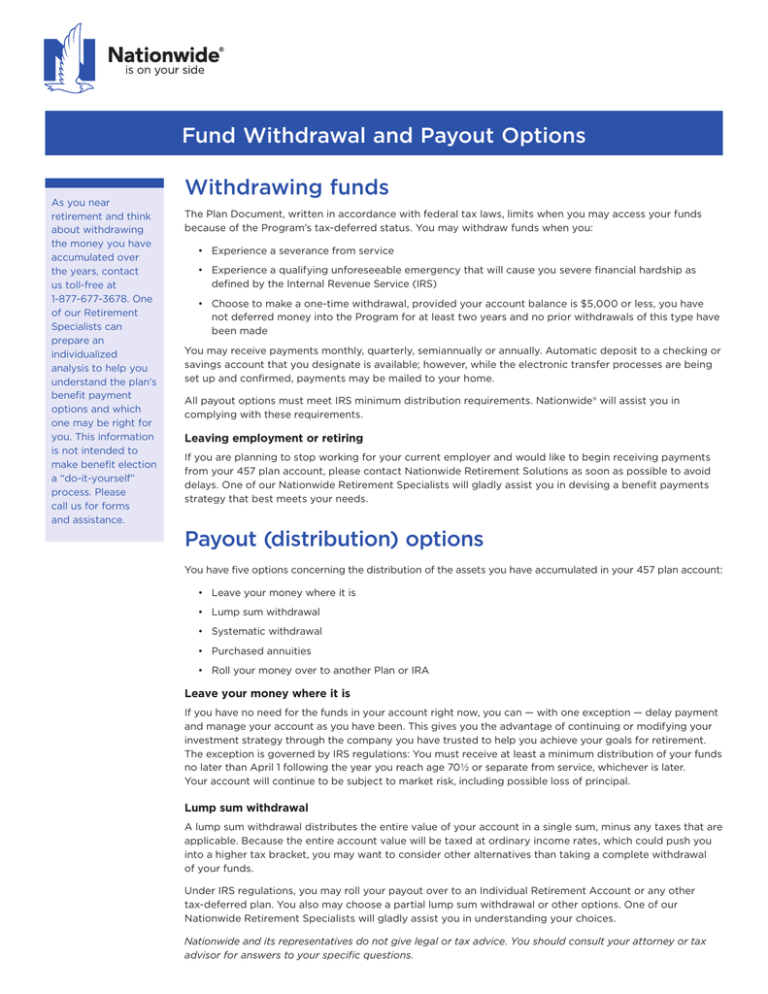

Options Fund Withdrawal And Payout Options

Recent Trends In Correspondent Banking Relationships In Policy Papers Volume 2017 Issue 018 2017

How 401 K Tax On Withdrawals Can Hurt Your Finances Credit Karma Tax

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

How A 457 Plan Works After Retirement

403b Withdrawal Rules Pay Tax On Retirement Income

4 Ways To Minimize Taxes On Retirement Plan Withdrawals Smartasset

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

Spending In Retirement Withdrawal Strategies And Tax Tips Principal

Should You Pay Off Your Home With Retirement Funds Pros And Cons

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Coronavirus Financial Hardship Withdrawal From 401 K Plans

Put Simply 72t Is An Internal Revenue Service Irs Rule That Allows For Penalty Free Early Withdrawal Individual Retirement Account Irs Retirement Accounts